Bank of England

Sentiment analysis of BoE speeches

Group Project

This group project was aimed at analysing how trends in the banks speeches correlate with observed events and economic indicators, as well as how the sentiment of these speeches can be used to predict market behaviour. This analysis will inform our understanding of the impact of the Bank’s communications on the economy, as well as the predictive power of using this data set.

-

The report considered 6 primary business questions as proposed by the Bank of England

1. Has the sentiment of central bank speeches changed over time? If so, how has it changed?

2. How does the sentiment of the Bank of England’s speeches correlate with key Events?

3. How does the sentiment of speeches correlate with key economic indicators of the UK?

4. Do these speeches have any predictive power to assist in predicting market behaviour?

5. Are there other insights or findings from the analysis that may be of interest to the organisation?

6. What are the potential reasons for any of the correlations discovered above? How have you drawn these conclusions?

-

The below are the personal responsibilities I had for this project:

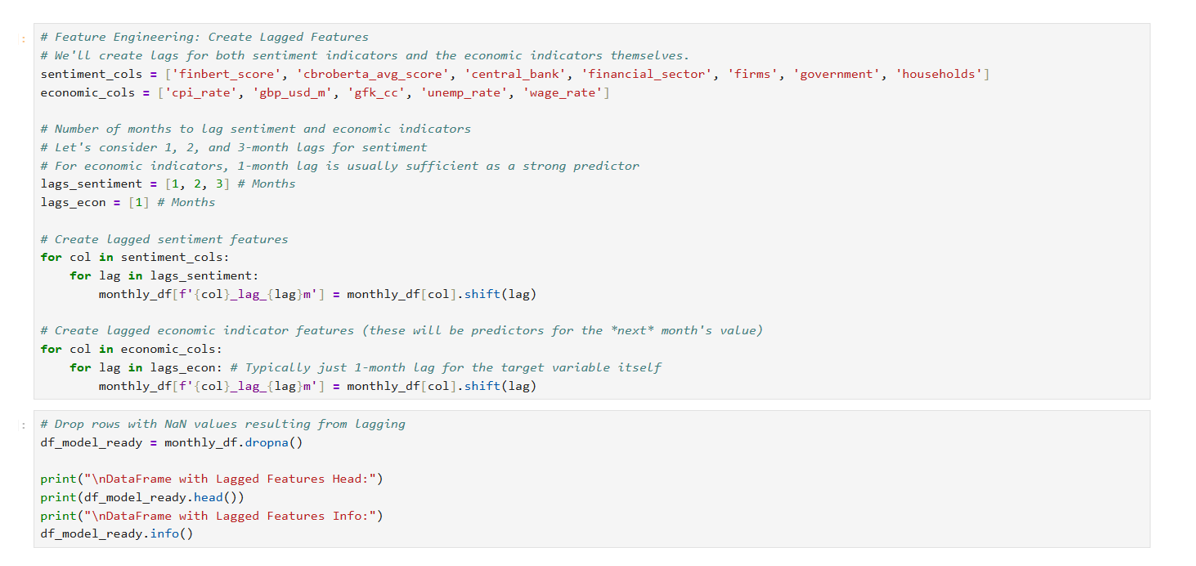

Conducted Natural Language Processing and Sentiment Analysis using machine learning models such as TextBlob, Vader, Finbert & Loughran McDonald to analyse the sentiment in Bank of England speeches

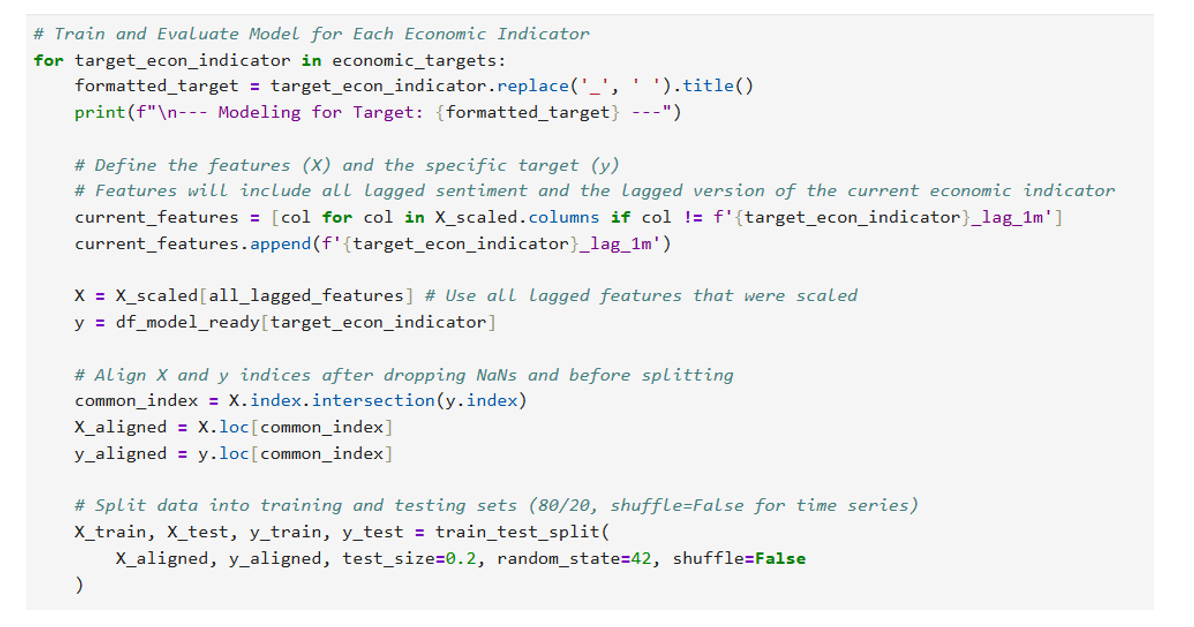

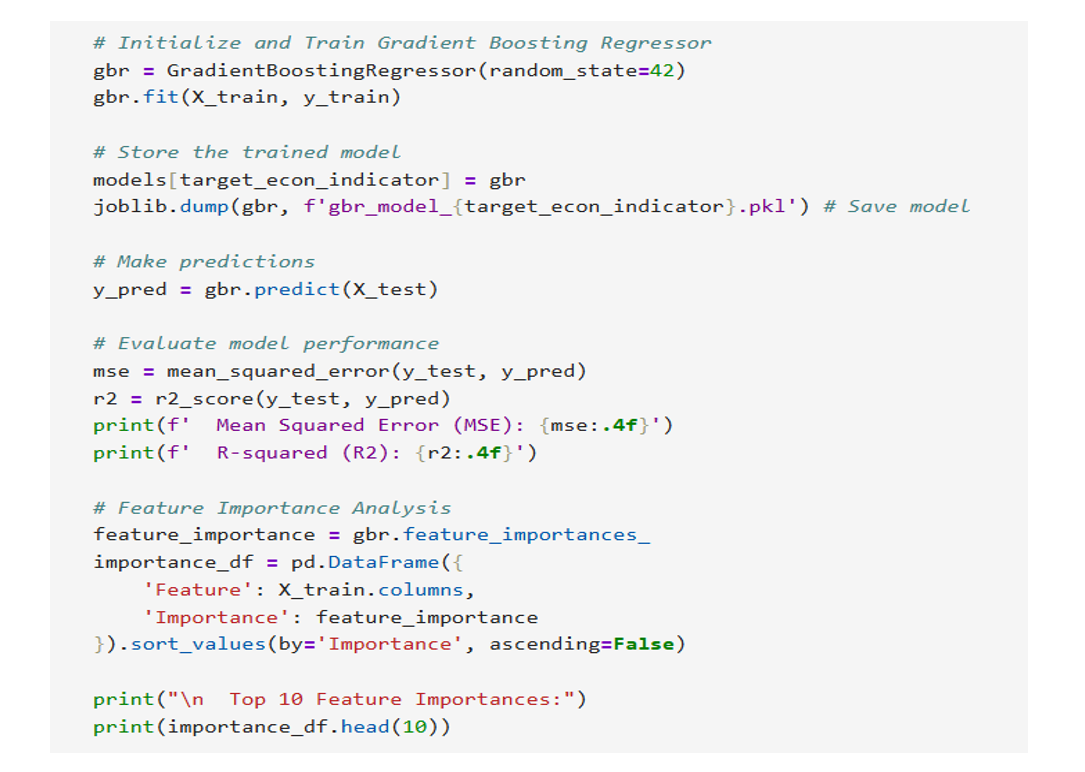

Implemented a Gradient Boosting regression model that demonstrated the predictive power of speech sentiment in predicting CPI rates.

-

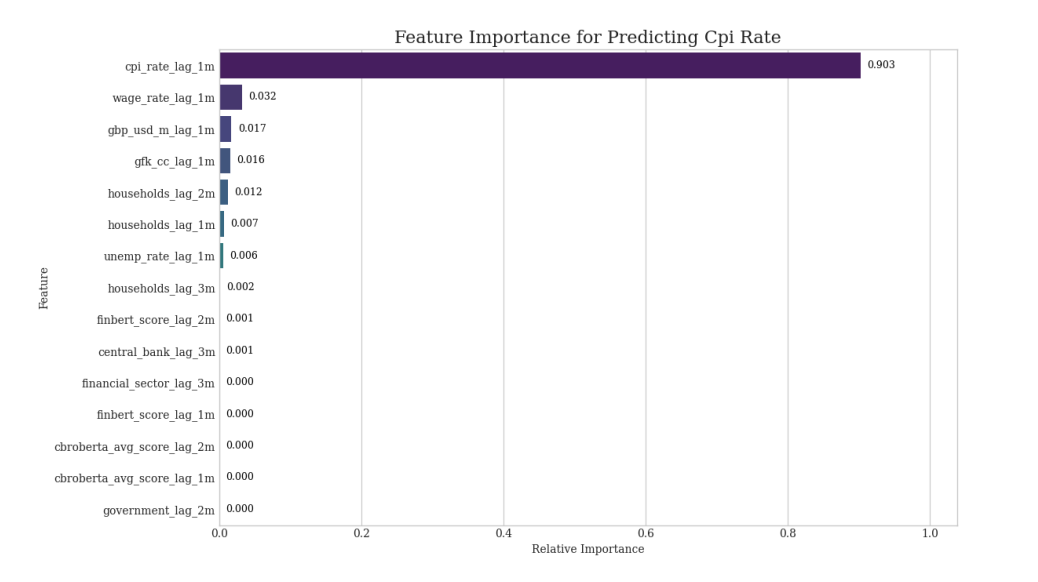

The agent-specific lagged CBRoBERTa score ‘households’, with a 2-month delay (Importance: 0.012) and a 1-month delay (Importance: 0.007), turned out to be the most influential. These insights show that the Bank's tone on households significantly contributes to predicting future inflation. As anticipated, the previous month's value of CPI was its strongest predictor. This underscores the inherent persistence and auto-correlation in inflation time series.

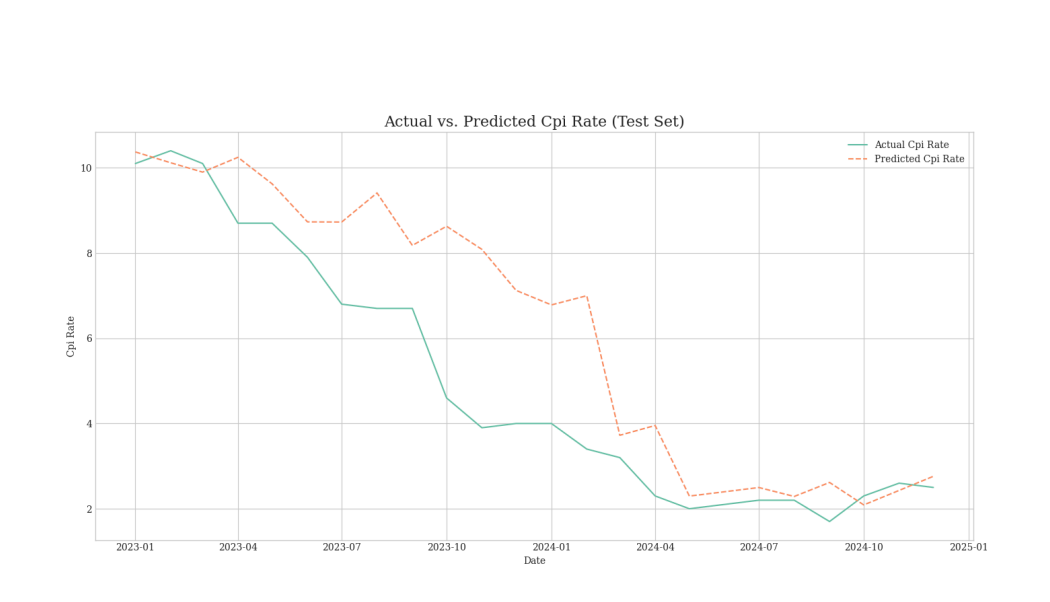

The model shows that past speech sentiment can indeed help explain and predict the direction of future economic indicators. Our model predicts Inflation rates well, explaining 57% of its variation, with a mean sqaured error of 3.73. Because financial markets strongly consider inflation, this forecasting ability gives market analysts valuable clues into its direction

-

Excel

Python (Jupyter Notebook)

Google Workspace

GitHub

-

This project lasted 6 weeks and I received a final grade of High Distinction

Key insights and recommendations

Insights and Recommendations

Key insights

The agent-specific lagged CBRoBERTa score ‘households’, with a 2-month delay (Importance: 0.012) and a 1-month delay (Importance: 0.007), turned out to be the most influential. These insights show that the Bank's tone on households significantly contributes to predicting future inflation. As anticipated, the previous month's value of CPI was its strongest predictor. This underscores the inherent persistence and auto-correlation in inflation time series.

The model shows that past speech sentiment can indeed help explain and predict the direction of future economic indicators. Our model predicts Inflation rates well, explaining 57% of its variation, with a mean sqaured error of 3.73. Because financial markets strongly consider inflation, this forecasting ability gives market analysts valuable clues into its direction

Key recommendations

Implement a Proactive Sentiment Intelligence System: Establish a dedicated, real-time sentiment monitoring dashboard within the Bank. This system should track not only overall sentiment but also granular sentiment towards key economic topics (e.g., 'financial sector', 'households', 'inflation outlook').Integrate these NLP-derived sentiment metrics directly into the Bank's economic analysis tools and dashboards, with a specific focus on incorporating the lagged sentiment indicators (e.g., sentiment 1-3 months prior) that our models identified as having significant predictive power. This provides a leading indicator for upcoming economic data releases.

Optimize Communication for Lagged Impact: Policymakers should strategize speech content and tone with an explicit understanding that the full economic noise of their words may not be immediate, but rather unfold over several months. For specific policy objectives, craft messages with identified sentiment facets in mind (e.g., focusing on a consistently positive 'financial sector' tone to subtly bolster exchange rates or investment confidence over the next 2-3 months).